I have become increasingly concerned that economists, politicians and journalists misrepresent the price students pay for higher education in the United States, by consistently overstating the real price of higher education relative to inflation. To my surprise, even though the CPI is based upon the actual “price paid” by consumers for goods and service, many economists use the “list price” institutions publish for tuition (in higher education parlance, the “book price”) rather than the “price paid” (in higher education parlance, the “net price”).

In general, book price is the amount paid by the wealthiest and least qualified admitted students, and the students with the highest academic merit and the most financial need pay the lowest net price, sometimes nothing. The students with average academic merit and financial need pay the average net price, a discount in the range of 40% to 50% of the book price in private institutions, more in public institutions. In this system, the wealthiest students subsidize the prices paid by the less wealthy students.

The economists who use book price to argue that college tuition has grown at a rate much higher than the rate of inflation should be ashamed. It’s net price that matters. The politicians who set policy based on that information are either unable to look more deeply at the data or are consciously taking advantage of bad data that fits their false narrative that they need to protect the people from uncaring institutions. The latter group has no shame. Journalists report on what the economists and politicians say, which is their primary job. They don’t have the resources to independently refute the inaccurate claims; that’s the job of those of us in the industry who should know better and should speak the truth.

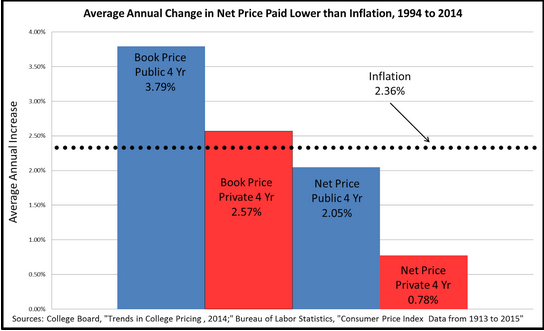

Here is the truth. The College Board publishes regularly “Trends in College Pricing,” which displays and explains changes in the book price and the net price in higher education. Note their definition of net price accounts for federal, state and institutional grants—not loans. There is a HUGE difference between the book price, the net price actually paid and their relationship to inflation.

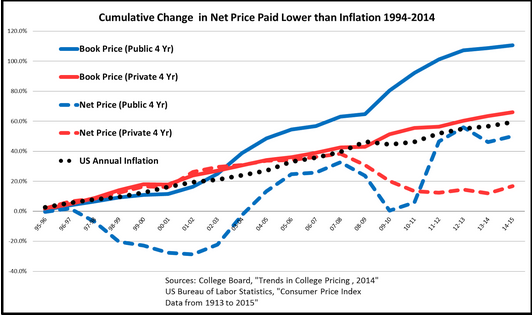

For the last two decades, the book price for tuition and fees at private colleges has exceeded the rate of inflation by 9% overall, but the net price actually paid has trailed the rate of inflation by 67%. Yes, the actual tuition paid by students for private higher education for the last 20 years has increased at about 1/3 the rate of inflation. In the public sector, book price has increased much more dramatically at more than double the inflation rate (61% more), but the net price actually paid has increased 13% less than the rate of inflation.

The difference between the private and public sector rates is primarily associated with declining appropriations to public colleges from the states, in large part a result of competing pressures for state expenditures from things like Medicaid. Those families that can afford a public higher education are paying closer to the real price of the service, which is an unintended but still sound policy change.

The following chart shows the average annual change over the last 20 years in book price, net price and inflation at colleges. Remember that net price is the price actually paid by the average student. This chart shows that the net price actually paid for college has been lower than the rate of inflation, substantially so in the private sector.

The following chart tracks annually the cumulative change in the price for college. It shows that the price for college has been at to substantially below the rate of inflation for two decades, except for public sector book price, which grew at a much higher rate beginning in 2003, when state governments began reducing appropriations for public colleges. The net price families actually paid for public and private colleges is below the rate of inflation overall.

So the truth is that the price the average student pays for a college education has been lower than inflation for two decades and those that pay more are the wealthiest students.

John Stevens, Ed.D.

John Stevens, Ed.D. Brendan Leonard, M.B.A.

Brendan Leonard, M.B.A.