A slow plodding revenue growth strategy may no longer provide private colleges with the financial reserves needed to survive. For decades, marginal increases in enrollment, tuition, and other revenue sources were good enough to cover expenses and provide a cash buffer against unforeseen changes in financial markets. However, those days are quickly fading into the past. Moody’s Investor Services, Bloomberg News, and the Wall Street Journal all claim that an increasing number of private colleges are in a death spiral due to shrinking enrollments and the costs of providing traditional and on-line programs that prepare students for the employment.

The following graphs illustrate the characteristics of the problem facing private colleges.

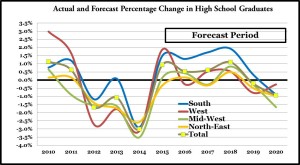

1. This graph shows the forecast for the traditional enrollment pool. Every region after 2015 shows declines, followed by an uptick in 2018 and then further declines.

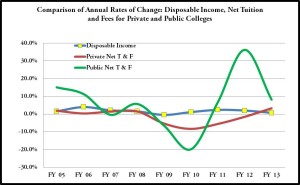

2. In FY 2009, public institutions began a major cycle for increased tuition and fees that exceeded disposable income. The public cycle turned down in FY 2012. Tuition and fees at private institutions have slowly approached disposable income until FY 2013, when they exceed disposable income.

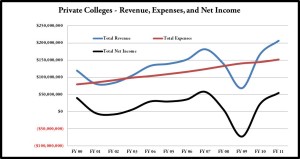

3. For private colleges, total revenue and total expenses track follow each other closely. They are out of synchronization when there are major changes in financial markets; i.e, the value of their endowment funds.

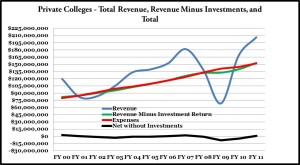

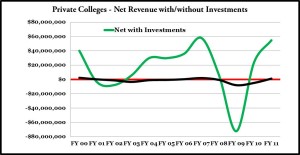

4. When investment income is removed from total revenue, revenue and expenses spiral around a common growth line.

5. This graph shows more clearly the impact of investments on net revenue.

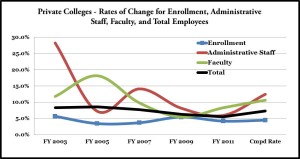

6. The interesting notes about the following chart are that for faculty the rate of change to lag enrollment until 2009, then it begins to outpace changes in enrollment Administrative staff generally follows the fall and rise in enrollment. However like faculty, except for FY 2009, both faculty and administrative staff outpace the rate of growth in enrollment.

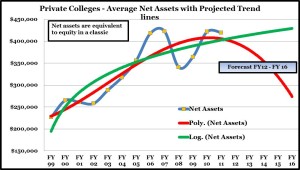

7. Here is a projection of net assets. The blue line is the average of actual net assets, the green line is the logarithmic projection, and the red line is a polynomial estimate of growth. Hopefully, higher education will see the logarithmic projection, but that will depend on changes in the value of investments and the impact of changes in enrollment.

Major financial challenges facing private institutions:

- High school graduates are forecast to be stable until 2016, when they will begin another major decline in all regions.

- In 2013, the rate of growth for tuition grew faster than disposable income

- Since 2000, total revenue was unstable due to three separate recessions

- If investments are removed, total revenue porpoises around expenses

- Administrative and academic-student services have become major drivers of expense growth

- Net assets varied widely due to major swings in revenue

- Net asset forecasts are unsettled, but not promising

Non-financial challenges facing private institutions:

1. Governmental regulations:

- Could limit tuition rate increases

- Possibility exists that “gainful employment” rules applied to for-profit colleges may also be applied to not-for-profit institutions.

2. Tenure expectations under accreditation regulations or rule often result in:

- Increasing breakeven points for tuition and for enrollment

- Limiting the flexibility of colleges to respond to fast paced change

- Defining curriculum structures

3. Technology:

- Changes how instruction is delivered

- Requires massive new capital investment

- Alters the competitive marketplace

4. The balance between the perceived cost of a degree and expected employment compensation is affecting college choice decisions.

The challenges are producing these pressures:

1. Pricing pressure from:

- Demand, fewer high school graduates

- Costs to support declining academic skills

- Cost of technology

- Cost of regulations, government and accreditation

- Unpredictable returns from investments

2. Operations do not produce sufficient cash to provide reserves in times of financial stress

How private colleges are being reshaped:

- Too many private colleges are operating at the margin putting them at risk as student markets change and new and costly technologies are introduced

- Private colleges cannot continue to increase their tuition discount without depleting the cash flow from tuition to support operations.

- Enrollment declines are depleting student markets

- Experience suggest that operations at many private college absorb cash and do not generate cash

- Cost structures are too expensive

- Existing markets (revenue sources) are not large enough to offset forecast shrinkage of the traditional market for high school graduates

- Data systems are inadequate to support operations and to improve student performance

- Investment policies are too volatile for many private colleges

As colleges are being reshaped, they are facing these existential issues:

- Are financial reserves being degraded at traditional bachelor degree granting colleges?

- Will private colleges and universities have the financial reserves to compete?

- Do private institutions have the administrative and technical skills to build a strong technological base?

- Can colleges find student markets that do not require huge investments in technology?

- Are private colleges willing to develop new ways of reducing costs, delivering instruction, and working with competitors?

- How long can a small college withstand significant declines in enrollment?

Probable outcomes from the challenges, pressures, and existential issues facing private colleges:

1. Colleges will look the same as they do now with minor changes to account for new regulations imposed by federal and state governments. (Estimated probability is 10%)

2. Most liberal arts colleges will be forced to redesign their programs to respond to parents and student demands that their degree prepares them for employment. (Estimated probability 30%)

3. Many liberal arts colleges will shift their resources toward internet delivery for day and continuing education students in order to cut costs generated by new regulations (such as new costs to increase graduation rates) and to respond to limits on tuition rates imposed by governmental regulations. (Estimated probability 15%)

4. Vendors will provide very cheap standardized, virtual reality, courses that colleges will buy replacing self-developed courses and full-time faculty. (Estimated probability 20%)

5. More colleges will face cash crises forcing them to: permanently cut expenses, merge, or close. (Estimated probability 15%)

6. Multiple colleges will create implied or pseudo mergers in which they build a separate institution owned by the participating colleges that contains several or all of the preceding five scenarios. (Estimated probability 10%)

John Stevens, Ed.D.

John Stevens, Ed.D. Brendan Leonard, M.B.A.

Brendan Leonard, M.B.A.