Michael Townsley author of a number of books on finance in higher education is working on a new book – Colleges in Crisis. The central theme of this book is that the massive decline forecast for prospective college students over the next decade will push many private colleges to and over the brink of survival. The book looks to answer this question:

‘What strategies can Presidents and Boards of Trustees apply to confront this crisis?’

The book covers: the decline in enrollment due to a collapse of the birth rate that is amplified by high cost of loans and the decline in liberal arts enrollment; inherent conflict within institution governance structure that delays strategic changes, and ways institutional leaders can move forward with strategic changes.Colleges in Crisis Statement Revision mkt 2 (1)

Section 1: Enrollment – Shrinking Demand

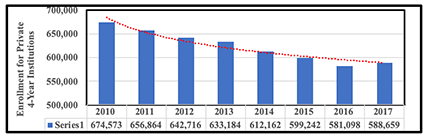

a. Current state of enrollment for Private 4-Year Institutions 2010 to 2017

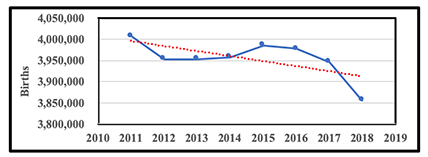

b. Birth Rates from 2010 to 2019

c. Investment in Education Hindered by Future Cost of Debt

Anna Maria Andriotis, Ken Brown and Shane Shifflett in a 2019 article in the Wall Street Journal reported that:

“The American middle class is falling deeper into debt to maintain a middle-class lifestyle. Cars, college, houses and medical care have become steadily more costly, but incomes have been largely stagnant for two decades,.[i]

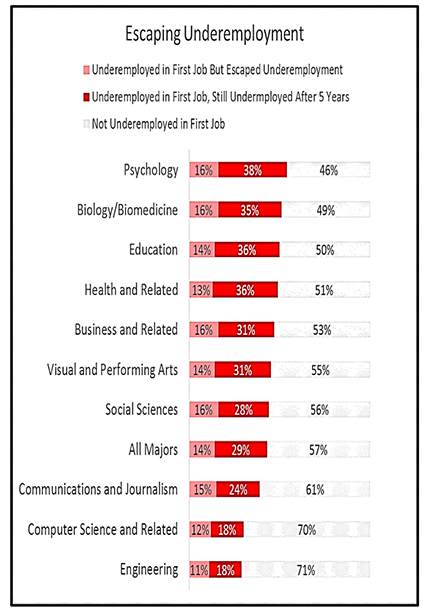

d. Shifting Preference for Academic Majors[ii]

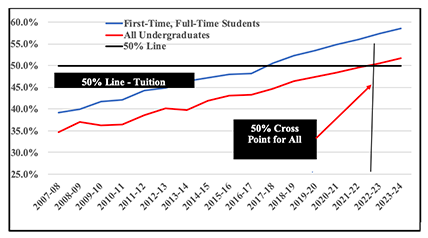

e. Price Competition – Tuition Discounting[iii]

Section 2: Private Colleges are Sliding into Financial Distress

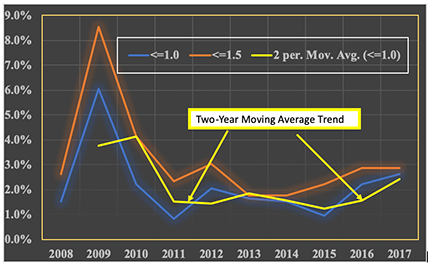

a. Percentage of Not-For-Profit Colleges Reporting Financial Distress Under the Department of Education’s ‘Test of Financial Responsibility’” for the Period: 2008 to 2017[iv]

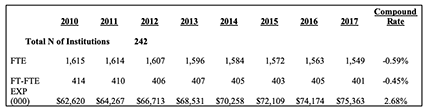

b. Institutional Averages: Full-Time Equivalent Students, First-Time, Full-Time Equivalent Students, and Total Expenses: Period 2010 to 2017[v]

Section 3: Causes of Resistance to Strategic Change

a. Contradictions of dual authority governance systems

b. Faculty tenure

c. Political model of decision-making through interest group subverts hierarchical decision-making

d. Constraints imposed by accreditors and regulators

e. Legal constraints – explicit and implied

f. Mismatch between human and tangible capital investment and the student market

Section 4: Strategic Options to the Coming Demographic Crash

a. Leadership Rubric of Change

b. Comprehensive Strategic Phased Planning

c. Partnership and Merger Options

Target for Publication: January 2020

Endnotes:

[i] Androitis, Ann Marie, Ken Brown, and Shane Shifflet (August 1, 2019); “Families Go Deep in Debt to Stay in the Middle Class”; Wall Street Journal; https://www.wsj.com/articles/families-go-deep-in-debt-to-stay-in-the-middle-class-11564673734.

[ii] Cooper, Preston (June 8, 2018/); Underemployment Persists Throughout College Graduates’ Career”; Forbes Magazine; https://www.forbes.com/sites/prestoncooper2/2018/06/08/underemployment-persists-throughout-college-graduates-careers/#547d9a087490.

[iii] “Private Colleges Now Use Nearly Half of Tuition Revenue for Scholarships (May 9. 2019); NACUBO.

[iv] “Federal Student Aid (Retrieved October 16 ,2019); “Financial Responsibility Scores”; Office of the U.S. Department of Education; https://studentaid.ed.gov/sa/about/data-center/school/composite-scores.

[v] John Minter & Associates (August 8, 2019); Data Extracted for a select set of colleges from the 2017 Data Set – Integrated Postsecondary Education System.

John Stevens, Ed.D.

John Stevens, Ed.D. Brendan Leonard, M.B.A.

Brendan Leonard, M.B.A.